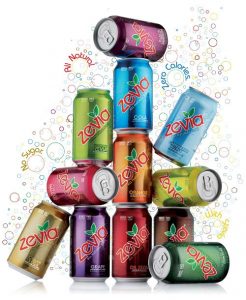

- Zevia CEO touts nutrition, low calories in push for customers

- Pepsi, Coke looking to shift online as soda market shrinks

May 5, 2017, 12:50 PM EDT – The race to sell soft drinks online has a surprising second-place winner: Zevia. The zero-calorie, sugar-free soda brand sold more online than Pepsi, Mountain Dew, Sprite or Dr Pepper, according to a new study.

The Los Angeles-based company only fell short of perennial soda king Coca-Cola, according to 1010data Inc., an analytics company. From March 2016 through February, Coca-Cola and its diet and zero-sugar versions held 22 percent of the U.S. e-commerce market and Zevia had 17 percent. Pepsi (and its zero-sugar and diet versions) trailed with 12 percent.

The playing field is more level for smaller competitors on the internet versus the grocery store, where the largest companies have spent years optimizing their positions on shelves, Zevia Chief Executive Officer Paddy Spence said in an interview.

“The whole basis for selecting products online becomes much more based on the product attributes,” Spence said. This includes calories and ingredients because consumers are looking for healthier options. Zevia beats its bigger rivals “every time from a nutritional perspective,” he said.

The biggest soda companies have struggled to cater to increasingly health-conscious consumers. Per-capita soda consumption fell to a 31-year low in the U.S. in 2016, according to Beverage-Digest, a trade publication. Coca-Cola and PepsiCo are trying to figure out the best way to migrate from brick-and-mortar stores to the virtual shelves that may be key for future growth.

Amazon.com Inc., the largest e-commerce retailer in the U.S., didn’t respond to a request for comment. But the site ranks its best-selling soft drinks in a list that’s updated hourly. As of Friday, Diet Coke ranked No. 1, followed by Bai Bubbles Voyager (a brand owned by Dr Pepper). Two other varieties of Coke were third and fourth, and Zevia rounded out the top five. PepsiCo made its first appearance at eighth with its flagship cola brand.

Amazon’s list of “most wished for” soft drinks — a ranking that tracks products on customers wishlists and gift registries — had Zevia at No. 1. Pepsi’s 1893, a craft-style soda that the company released last year, fared well on that list, coming in at third.

During a company presentation in February, Coca-Cola CEO James Quincey emphasized the rising importance of e-commerce and said the company needs to make sure its products are “within a click’s reach of desire.”

PepsiCo CEO Indra Nooyi echoed this sentiment in a call last month, saying the company is striving “to create impulse online.”

“It’s a work in progress, but I must tell you that our growth rates are quite impressive,” she said.

The vast majority of beverage sales still happen in stores, where Zevia still sells very little compared with Coca-Cola and PepsiCo brands. It made up only 0.1 percent of carbonated soft-drink sales in U.S. stores in the 52-week period ending April 23, according to IRI data. Coca-Cola Classic alone took 18 percent over the same period, while Diet Coke held 9 percent. Pepsi-Cola and Mountain Dew each made up 11 percent.

But the e-commerce market gives Zevia a way to overcome the marketing budgets of larger rivals, Spence said.

“That online venue, being information rich and education focused, really plays to our strengths,” he said

By Jennifer Kaplan for Bloomberg News