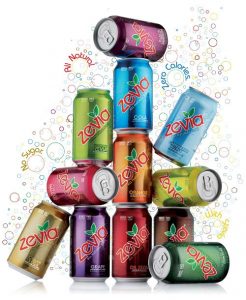

BEVERAGES: Zevia bested all competitors except Coke with healthier alternatives.

Azero-calorie soda company is rising to the top in online sales as American consumers thirst for healthier alternatives.

Zevia, which sweetens its drinks with sugar substitute stevia, sold more of its branded soda online in the United States than any other brand except Coca-Cola for the year ended in February, according to a new report from New York industry analytics firm 1010data.

Sales of the Encino company’s drinks made up 17 percent of the online market, compared with 22 percent for the Coca-Cola Co.’s flagship beverage. The next closest was Pepsi with 12 percent. The report didn’t include sales numbers.

Paddy Spence, Zevia’s chief executive, said the internet provides the company a more level playing field than retail stores, where industry giants have strong relationships with distributors. His company generated less than $200 million in revenue last year.

Spence also said it is a sign of things to come as customers’ tastes change.

“The online market tends to skew younger than brick-and-mortar,” Spence, 50, said. “We see it as a leading indicator of what we’re going to see down the road. Younger shoppers are more focused on better-for-you products.”

The amount of soda consumed by Americans on average declined to a 30-year low in 2015, according to data from Beverage Digest. In response, big soda makers are buying startups selling healthier offerings.

Coca-Cola, which reported almost $42 billion in net operating revenue for the year ended Dec. 31, bought L.A.’s Zico Coconut Water in 2013 for an undisclosed amount. Last year, Pepsico Inc., which generated almost $63 billion over the same period, announced that it would acquire Oxnard kombucha maker KeVita, founded in 2009, for a reported $200 million.

Dr Pepper Snapple Group, which had net sales of $6.4 billion, acquired Bai Brands, a maker of flavored waters, tea, and soda, for $1.7 billion last year.

Since Spence bought Zevia, founded in 2007, with Syosset, N.Y.’s Northwood Ventures in 2010, sales have multiplied tenfold, he said.

In addition to Spence and Northwood, the company is co-owned by the management team and Seattle family office Laird Norton Co. Although it has less than 50 employees, Zevia outgrew its space in Culver City and moved to Encino two years ago. The company produces its drinks at 12 manufacturing plants around the country.

The rapid growth has prompted offers for acquisitions, Spence said, but Zevia is considering an initial public offering.

The company’s introduction in recent years of flavored sparkling water and energy drinks means consumers can drink Zevia beverages during every part of the day, he said.

“Now we have something for every member of the family from the moment they wake up until they go to sleep,” he said. “It’s a pretty neat place to be as a company.”

Beyond El Segundo

Beyond Meat, an El Segundo maker of a meat alternative, is increasing its reach with a deal to be distributed in 280 Safeway Inc. stores in Northern California, northern Nevada, and Hawaii.

The company, founded in 2009 by Ethan Brown, announced the news last week. Its patties made of peas are also available in certain Ralphs, Whole Foods Markets, and other outlets. The company started selling its Beyond Burgers in Whole Foods in May of last year, according to a spokeswoman’s email.

The company has raised $17 million from investors including Bill Gates, General Mills, Tyson Foods, and Kleiner Perkins Caufield & Byers.

Safeway is owned by New York private equity firm Cerberus Capital Management.

Fancying a Change

A local gourmet ice-cream maker has left the San Fernando Valley for downtown.

Nancy’s Fancy, founded by Nancy Silverton of La Brea Bakery in 2015, moved from the North Valley into a 6,000-square-foot manufacturing facility in the Arts District, the company announced last week.

“Having a new, much larger facility designed specifically for the product will give us the opportunity to do some things I’ve been wanting to do, such as expand the flavor line and possibly add toppings and sauces,” Silverton said in a statement. “The thriving neighborhood also makes our new location ideal for a scoop shop.”

The facility was previously occupied by New York chocolate maker Mast Brothers, who moved out less than a year after moving in, Nancy’s Fancy said.

The company’s gelatos and sorbettos are sold at Whole Foods, Bristol Farms, and Gelson’s.

By Caroline Anderson for Los Angeles Business Journal