CrossFit has signed its first and only soda sponsor, maintaining that it is continuing its fight against sugary beverages in the process. The sponsor is Zevia, which will pay low-to-mid six figures for a one-year deal to align itself with the strength and conditioning brand made popular for its fitness program and annual games.

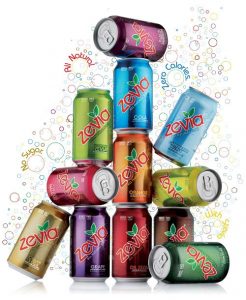

The sponsorship is notable not only for the price tag, but also given CrossFit founder and CEO Greg Glassman’s active fight against sugary beverages. Zevia fits within Glassman’s mission, as it is naturally sweetened with stevia (hence, the name Zevia) and monk fruit, and is Non-GMO Project Verified as well as color-free across all 15 of its flavors.

It also seems like a smart match for Zevia, since it can promote its products to a wide range of millennials. Almost half of the people whom participate in CrossFit are considered millennials and Zevia currently gets 2.3x more of its dollars from millennials than the traditional diet soda category — 28.4% of Zevia’s revenue comes from millennials versus 12.2% of the overall soda category, according to Zevia CEO Paddy Spence.

Zevia’s sponsorship of the CrossFit Games is to include branding and sampling on-site at events along with exposure on CrossFit’s digital and social media properties. Zevia branding will be promoted surrounding CrossFit’s 6 major regional events as well as on ESPN broadcasts — roughly 26 hours of footage, says Spence.

The brand’s other sports-related sponsorship is with Major League baseball’s Oakland A’s. It has been a sponsor of the A’s for the last three seasons and is the only zero calorie, natural soda in MLB history.

“What’s wild about pro sports is that it’s completely dominated by Coca-Cola and Pepsi ,” said Spence. “Yet what the Oakland A’s found was a lot of families coming to the ballpark and wanting better options. CrossFit is a similarly broad audience and skews millennial like our brand does. The A’s are pretty much a general audience sports, though, and CrossFit is very much a mission driven organization pushing a lifestyle that is anti-sugar.”

Spence added that Zevia is in the process of talking to a number of other professional sports organizations about possible sponsorship opportunities. Additionally, while Zevia’s sponsorship with CrossFit is only 1 year in length, Spence envisions a long term partnership in the future.

“CrossFit has been extremely outspoken in terms of their opposition to excess sugar consumption, especially in soda and other sugary beverages,” explained Spence, who added that the brand has been, “quite anti-soda as an organization.”

That is a promising premise, as Zevia is currently #12 among the top 20 low/zero calorie soda brands in the U.S., per Spence. Its standing as the only natural brand in the top 20 makes it a strong fit for CrossFit’s audience.

The Zevia brand is roughly 8 years old and was purchased by Spence 5.5 years ago. Spence was previously Kashi’s first head of sales and has a background in the natural foods industry.

“16 years ago, my wife and I went off sugar and started using stevia every day. It changed my life as to how I felt,” said Spence. “Diabetes kills more people than AIDS, malaria and tuberculosis worldwide combined. While one can of Diet Coke isn’t going to kill you, no one is feeling good about the amount of artificial sweeteners they’re consuming.”

Big soda companies continue to see their consumption declining. Coca-Cola saw its profit fall 5% in first quarter 2016, with net operating revenue dropping 4% during that same period. Spence has grown his company 8x on a revenue basis since 5 years ago.

But Zevia’s battle is just beginning. It will continue to compete against the likes of Diet Coke, Diet Pepsi and Diet Canada Dry. Spence is confident that a narrowing price gap between his product and the more traditional brands, as well as a proclivity to use stevia-based products will help diminish the sizable spread. He also believes that more sports organizations like CrossFit will not only look to the bottom-line on sponsorship deals and seek to find the right fit before signing contracts.

“It’s not going to be any longer about who writes the biggest checks,” said Spence. “It’s going to be finding brands that really align with your audience. I think consumers today are more sophisticated and powerful than they’ve ever been. An association of a brand that consumers perceive negatively actually does rub off on an associated brand or celebrity.”

By Darren Heitner for Forbes