LOS ANGELES–(BUSINESS WIRE)–Zevia PBC (NYSE:ZVIA) today announced the pricing of its initial public offering of 10,700,000 shares of its Class A common stock at a public offering price of $14.00 per share. The shares are expected to begin trading on the New York Stock Exchange on July 22, 2021 under the ticker symbol “ZVIA.”

In addition, Zevia has granted the underwriters a 30-day option to purchase up to an additional 1,605,000 shares of its Class A common stock at the initial public offering price, less underwriting discounts and commissions. The offering is expected to close on or about July 26, 2021 subject to satisfaction of customary closing conditions.

Goldman Sachs & Co. LLC, BofA Securities and Morgan Stanley are acting as lead book-running managers for the proposed offering. Stephens Inc., BMO Capital Markets and Wells Fargo Securities are acting as joint book-running managers. Telsey Advisory Group, Loop Capital Markets, Academy Securities, AmeriVet Securities and Ramirez & Co., Inc. are acting as co-

managers.

A registration statement relating to the shares being sold was filed with the U.S. Securities and Exchange Commission and became effective on July 21, 2021. This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor will there be any sale of any of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or

jurisdiction.

The offering may be made only by means of a prospectus. Copies of the final prospectus related to the offering may be obtained, when available, from:

Goldman Sachs & Co. LLC

Prospectus Department

200 West Street

New York, NY 10282

Telephone: 1-866-471-2526

Facsimile: 212-902-9316

or by emailing Prospectus-ny@ny.email.gs.com

BofA Securities

NC1-004-03-43

200 North College Street, 3rd Floor

Charlotte, NC 28255-0001

Attn: Prospectus Department

dg.prospectus_requests@bofa.com

Morgan Stanley & Co. LLC

Attn: Prospectus Department

180 Varick Street, 2nd Floor

New York, NY 10014

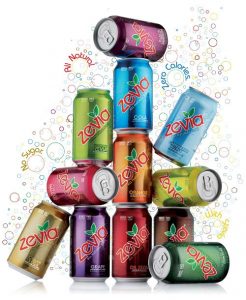

About Zevia

Zevia PBC, a Public Benefit Corporation, is a certified B Corp focused on addressing the global health challenges resulting from excess sugar consumption by offering a broad portfolio of zero sugar, zero calorie, naturally sweetened beverages. Beverages are made with a handful of simple, plant-based ingredients, contain no artificial sweeteners, and are Non-GMO Project verified, gluten-free, Kosher, vegan, zero sodium and free of added color. As of 2020, Zevia is distributed in more than 25,000 retail locations in the U.S. and Canada through a diverse network of major retailers in the food, drug, mass, natural and

ecommerce channels.

Stephanie Schonauer

Investors

714-313-7827

steph@zevia.com

Sarah Kissko Hersh

Media

646-283-8508

skisskohersh@percepture.com

Reed Anderson

ICR

646-277-1260

reed.anderson@icrinc.com